Battle Creek, Michigan, earned its nickname “Cereal City” over 130 years ago when entrepreneurs C.W. Post and W.K. Kellogg started their breakfast cereal companies in the 1890s. Now that legacy faces serious trouble. Post Consumer Brands announced plans to cut 71 jobs at its Battle Creek plant on January 8, 2026. The company will discontinue production of Honeycomb cereal, all peanut butter products, and certain granola items at its 275 Cliff Street facility.

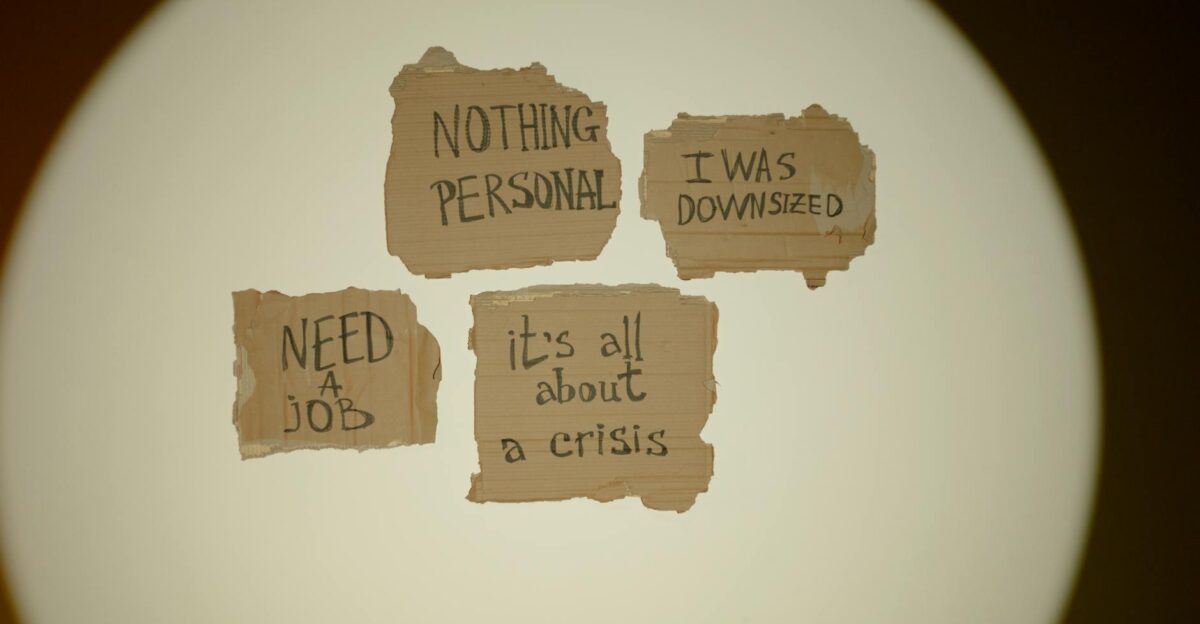

This closure affects 30 production workers and union members, who have just 14 days’ notice. The job cuts reflect a broader crisis—U.S. manufacturing lost 67,000 jobs between April and November 2025, with the sector shrinking for five consecutive months. Michigan alone has shed 6,300 factory jobs since February. Battle Creek’s unemployment rate jumped to 7.4% in July 2025, the steepest increase among Michigan cities, though it improved to 5.1% by September. The city now employs 61,112 people, far below its 2001 peak of 68,873 workers.

Multiple pressures squeeze manufacturers today. The Trump administration imposed tariffs ranging from 10% to 145% on imports in 2025, with duties on steel and aluminum reaching 50%. These tariffs drove aluminum prices up 10.3% compared to last year. Over 75% of manufacturers now list trade uncertainty as their biggest concern, especially small companies struggling with packaging cost increases. While Post didn’t blame tariffs for closing its Battle Creek plant, other companies did—auto supplier Stellantis cut 900 jobs in April 2025 specifically because of tariff impacts.

Why Americans Stopped Eating Cereal

Generation Z has transformed breakfast habits, and cereal companies have struggled to keep up. Americans bought 2.5 billion cereal boxes in 2021 but only 2.1 billion in 2024—a 13% drop in just three years. YouGov surveys found that 55% of people aged 16 to 34 skip breakfast entirely, choosing protein-rich foods like Greek yogurt or overnight oats instead. The cereal category has declined for 25 consecutive years, despite companies introducing new flavors and launching marketing campaigns.

Post Consumer Brands CEO Nicolas Catoggio confirmed that ready-to-eat cereal sales continue to decline, with his company’s volumes down 2.3%. COO Jeff Zadoks told analysts that small premium brands like Magic Spoon—which offers 12 grams of protein per serving—steal market share from big companies. Large factories struggle to make small batches profitably. Honeycomb cereal’s story shows these challenges clearly.

Post launched the honey-flavored corn cereal in 1965 with a catchy jingle, and it remained a success for 40 years. However, a 2006 formula change for fiber upset fans. Post attempted to fix the problem with an “improved taste” version in 2007 and introduced new varieties, such as strawberry and chocolate, but sales never recovered. The company even hired actor Terry Crews to promote “Big Honey” campaigns in 2024, but nothing worked.

Euromonitor analyst Tom Rees explained that the image of cereals as unnatural food hurts sales, while shoppers demand simpler ingredients. YouGov’s Kenton Barello noted that 55% of young adults practice intermittent fasting, which significantly alters their meal patterns. Analysts suggest repositioning cereal as snacks, but Post chose to cut factory capacity instead.

Workers and Community Face Uncertain Future

Post’s Battle Creek closure fits a broader consolidation strategy. In April 2025, the company announced that it would shut down plants in Ontario and Nevada, eliminating 300 jobs and saving $21 million to $23 million annually starting in fiscal 2026. These closures cost $63.5 million to $67.5 million upfront. CEO Catoggio said the moves reduce excess factory capacity and optimize the manufacturing network.

Workers face limited options after the Battle Creek closure. Specialized skills for making products like Honeycomb don’t transfer easily to other jobs, though some employees might relocate to other Post plants. Union bumping rights offer little help when closures become permanent. Manufacturing jobs in the area shrank 3.9% year-over-year through mid-2025.

One bright spot emerged in October 2025 when Ferrero acquired WK Kellogg Co., preserving 850 jobs—but questions remain about how long those positions will last. Battle Creek now stands at a crossroads. City leaders explore ways to reinvent the local economy beyond cereals as Post trims operations and Kellogg’s former museum remains closed since 2007. Continued sales declines could test remaining company commitments, leaving workers and the community to navigate an uncertain path forward.

Sources

Bridge Michigan, Battle Creek faces life after Cereal City following Kellogg sale, 5 Dec 2025

Food Dive, Post to shutter 2 plants cut 300 jobs as cereal category struggles, 9 Apr 2025

Michigan Department of Labor and Economic Opportunity WARN database, Notice of Employee Separations at Post Consumer Brands, 31 Oct 2025

Bakery and Snacks, Who killed the cereal bowl Breakfast isn’t what it used to be, 21 Apr 2025

Food Dive, Post Holdings sees cereal demand dip as Gen Z seeks healthier better-for-you alternatives, 10 Feb 2025

Fortune, How Gen Z killed cereal They are going about breakfast in a different way, 13 Jul 2025