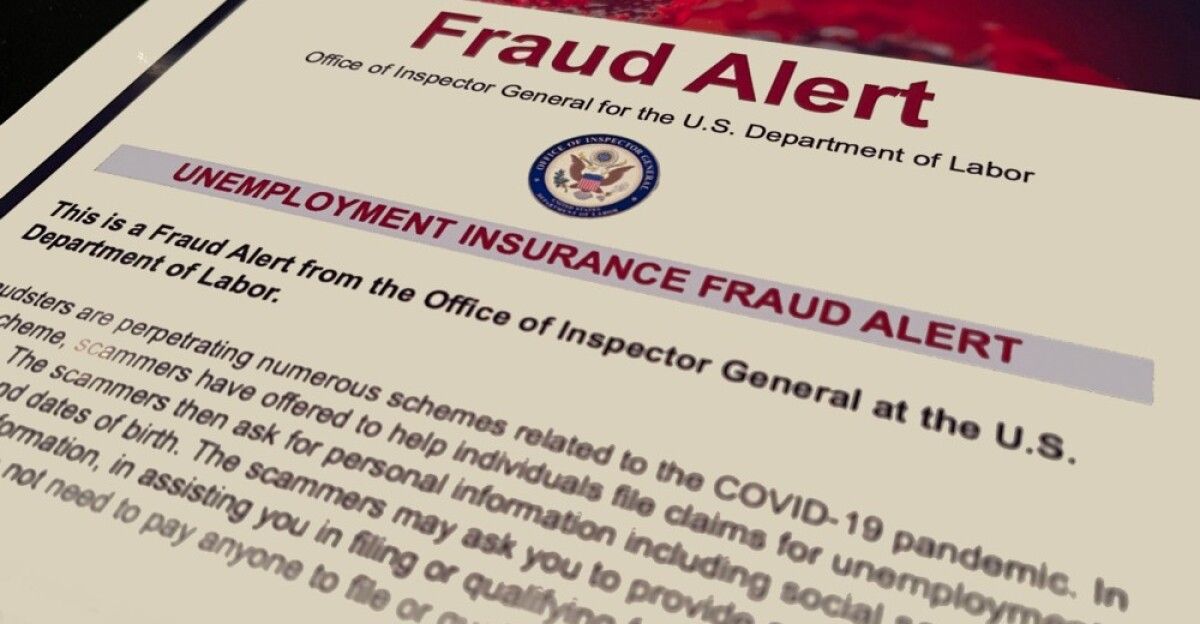

Maryland’s unemployment insurance system overpaid $807.4 million between November 16, 2020, and January 15, 2025, according to a state audit. Investigators identified 46,986 fraudulent claims, largely tied to out-of-state identity theft schemes, accounting for $493.9 million.

Auditors concluded that $760.7 million became uncollectible by May 2025 after recovery deadlines were missed, exposing major weaknesses in oversight, timing, and fraud detection within the Division of Unemployment Insurance.

Pandemic Origins

The overpayments trace back to the COVID-19 pandemic, when unemployment claims surged and states rushed to distribute CARES Act funds. Maryland prioritized speed over verification as claims volumes overwhelmed existing systems.

That environment created opportunities for identity theft and organized fraud, mirroring national trends in which roughly 10 percent of federal pandemic unemployment payouts were later identified as improper or fraudulent.

Fraudulent Claims Breakdown

Auditors determined that $493.9 million of Maryland’s overpayments stemmed from 46,986 out-of-state fraudulent claims. These cases frequently involved stolen identities and debit card withdrawals rather than legitimate Maryland workers.

The scale and geographic spread indicated coordinated schemes exploiting verification gaps, with controls meant to flag suspicious locations and activity applied inconsistently.

BEACON System Failures

Maryland’s BEACON unemployment platform, rolled out in 2020, contributed to the issues. The transition created account reconciliation problems that went unresolved while claims were paid.

Auditors found the Division of Unemployment Insurance failed to properly balance accounts or verify adjustments during the rollout, allowing fraudulent claims to persist and funds to be released without adequate validation.

Recovery Timeline Delays

The audit concluded that Maryland missed a critical federal recovery deadline of December 31, 2024, for certain overpayments.

As a result, $760.7 million in overpayments were deemed no longer collectible by May 2025. While the Department of Labor disputes that figure, auditors emphasized that delays—rather than lack of authority—were the primary reason such a large share of funds became uncollectible.

Oversight Gaps Exposed

A recurring theme in the audit was the absence of consistent supervisory review. Claims, vendor activity, and system alerts often lacked documented approval or follow-up.

This oversight gap allowed fraudulent payments to continue and limited the state’s ability to respond quickly once problems were identified, compounding losses over multiple years.

National Fraud Context

Maryland’s experience fits a broader national pattern. During the pandemic, states processed unprecedented volumes of unemployment claims while distributing massive federal aid.

Nationwide estimates suggest more than $36 billion in CARES Act unemployment funds were potentially fraudulent, highlighting how emergency conditions strained safeguards across nearly every state system.

Recovery Efforts

The Maryland Department of Labor reports that $191.5 million in overpayments were recovered as of September 2025.

The agency also states that $1.3 billion in overpayments remain under active pursuit. Auditors acknowledge these efforts but caution that recovery success does not offset losses tied to missed deadlines and delayed enforcement.

Verified Overpayment Scale

The Office of Legislative Audits confirmed the $807.4 million overpayment total for the defined audit period. Most improper payments involved federal pandemic funds administered by the state.

By May 2025, auditors determined that $760.7 million had aged beyond recovery limits, significantly narrowing the state’s ability to reclaim taxpayer money.

Out-of-State Claims Detail

The 46,986 confirmed fraudulent claims largely originated outside Maryland, bypassing safeguards intended to detect geographic inconsistencies. Identity theft was a dominant tactic, with stolen personal information used to file claims and route benefits to debit cards.

Auditors concluded that earlier intervention could have stopped many of these payments.

Legal Stall Impact

Collection efforts were halted from January 2022 through September 2023 due to a legal challenge. While the pause was court-ordered, auditors noted that the suspension significantly reduced recovery prospects.

Once collections resumed, valuable time had already been lost, allowing many debts to age past enforceable recovery windows.

Contract Employee Crimes

The audit also highlighted insider abuse. In mid-2024, two contract employees pleaded guilty to aggravated identity theft after exploiting BEACON system access to steal roughly $3.5 million.

While small compared to total losses, the case underscored weaknesses in access controls and monitoring within the unemployment system.

Debit Card Anomalies

Auditors found that approximately $3 million of the $493.9 million in fraudulent out-of-state payments could not be fully traced.

These funds were withdrawn via debit cards during early pandemic months, when transaction tracking and reconciliation were incomplete, leaving gaps that investigators could not conclusively resolve.

Supervisory Review Deficit

Repeated audits documented the same core problem: missing or inconsistent supervisory checks. Claims approvals, vendor oversight, and fraud alerts often lacked formal review.

This systemic issue allowed errors and fraud to compound over time, even after warning signs had already been identified in earlier reports.

Federal Funds Dominance

The overwhelming majority of the $807.4 million in overpayments involved federal CARES Act and related pandemic assistance.

While the funds originated federally, Maryland was responsible for administration and recovery, placing accountability for controls, verification, and follow-up squarely on state agencies.

Post-2023 Collection Lapses

Even after the legal suspension ended in September 2023, auditors found that $33.6 million in overpayments were not adequately pursued.

Missing notices, delayed referrals, and incomplete documentation further reduced recoverable amounts, adding to the losses already locked in by earlier delays.

Cyber Red Flags

The audit referenced cybersecurity concerns tied to fraudulent claims but redacted sensitive details.

The findings indicate that system vulnerabilities were known yet insufficiently addressed, reinforcing concerns that technical weaknesses—combined with high claim volumes—made fraud easier to execute and harder to detect.

Recovery Claims Scrutiny

State officials argue that unrecoverable losses are closer to $600 million, not $760.7 million, citing ongoing recoveries and disputed classifications.

Auditors counter that statutory deadlines define collectibility, regardless of intent or effort, making timing—not pursuit—the decisive factor in determining losses.

Strategic Imperative

The scale of the overpayments highlights an urgent need for stronger identity verification, real-time audits, and faster recovery action.

Lawmakers and auditors agree that without structural reforms, future crises could again overwhelm safeguards, leaving taxpayers exposed to massive losses.

Fiscal and Political Fallout

The audit arrives as Maryland faces a $1.6 billion budget deficit and the 2026 General Assembly convenes. Lawmakers have sharply criticized the failures, calling them a breakdown in stewardship.

With hundreds of millions gone and billions still under review, the episode now shapes debates over accountability, reform, and public trust in state financial management.

Sources:

“Maryland Labor Dept. missed chance to recover $760 million in overpaid unemployment, audit says” – WTOP News

”Audit: $800M Of Unemployment Overpayments Went Uncollected In Maryland” – The BayNet

“Maryland sends 180,000 unemployment repayment notices tied to years-old claims” – WMAR-2 News

”Audit exposes $760 million in uncollectable overpayments; state officials point fingers” – FOX Baltimore