Six years ago, Ilhan Omar arrived in Congress carrying $25,000 to $65,000 in debt. Today, she and her husband, Tim Mynett, report combined assets between $6 million and $30 million—a 3,500 percent wealth surge in one term.

This meteoric rise coincides with federal prosecutors charging more than 90 people in industrial-scale fraud across Minnesota’s social programs, raising questions about transparency and timing.

Rose Lake Capital

Rose Lake Capital, co-founded by Mynett in Washington, D.C. in 2022, reported assets under $1,000 in Omar’s 2023 disclosure. One year later, the venture firm was valued between $5 million and $25 million.

The company’s website claims management of $60 billion across 80-plus countries, with five diplomats on staff. However, Omar’s 2024 filing reported zero income from Rose Lake, down from $15,000 to $50,000 the previous year.

Nine Prominent Democrats

Rose Lake Capital removed nine officers and advisors from its website, including former Obama Ambassador to Bahrain Adam Ereli, former Senator and Ambassador to China Max Baucus, former DNC Treasurer William Derrough, and Keith Mestrich, former Amalgamated Bank CEO.

None face charges or accusations of wrongdoing. The removals coincided with intensifying federal prosecutions in Minnesota during September and October.

Industrial-Scale Fraud

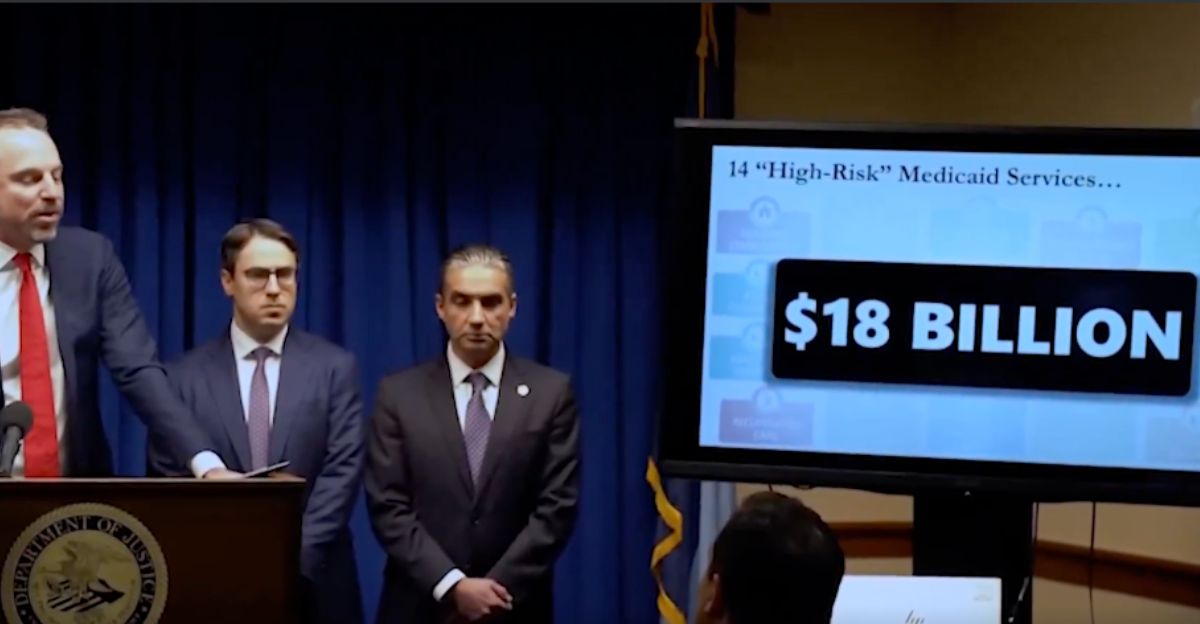

First Assistant U.S. Attorney Joe Thompson announced that prosecutors estimate half or more of the roughly $18 billion allocated to 14 Minnesota programs since 2018 may have been fraudulently obtained.

More than 90 people now face charges across multiple schemes. Thompson stated: “Every day we look under a rock and find a new $50 million fraud scheme.”

$250 Million Theft

At the heart of the scandal lies Feeding Our Future, accused of orchestrating the largest pandemic relief fraud in American history. Federal prosecutors say conspirators stole approximately $250 million from the Federal Child Nutrition Program by falsely claiming to feed millions of children during COVID-19.

Founder Aimee Bock and co-defendant Salim Said, owner of Minneapolis’s Safari Restaurant, were convicted in March 2025. Prosecutors have secured at least 59 convictions.

The Meals Act

Representative Omar introduced the MEALS Act on March 11, 2020, authorizing the Agriculture Department to waive certain oversight requirements for school meal programs during the pandemic.

When asked if she regrets the bill, Omar responded, “Absolutely not, it did help feed kids.” Prosecutors say conspirators exploited loosened requirements by submitting fake invoices, fabricated attendance records, and falsely claiming meal distribution from hundreds of nonexistent sites.

Three Omar Connections

Omar hasn’t been charged, but three individuals with alleged ties to her appear in the indictments. Guhaad Hashi Said, described by her 2025 Republican opponent as a campaign “enforcer,” faces conspiracy charges for operating a site that falsely claimed to serve 5,000 daily meals.

Omar’s campaign received donations from at least three individuals who are now convicted fraudsters. She stated she returned the money after the convictions.

Politics Meets Fraud

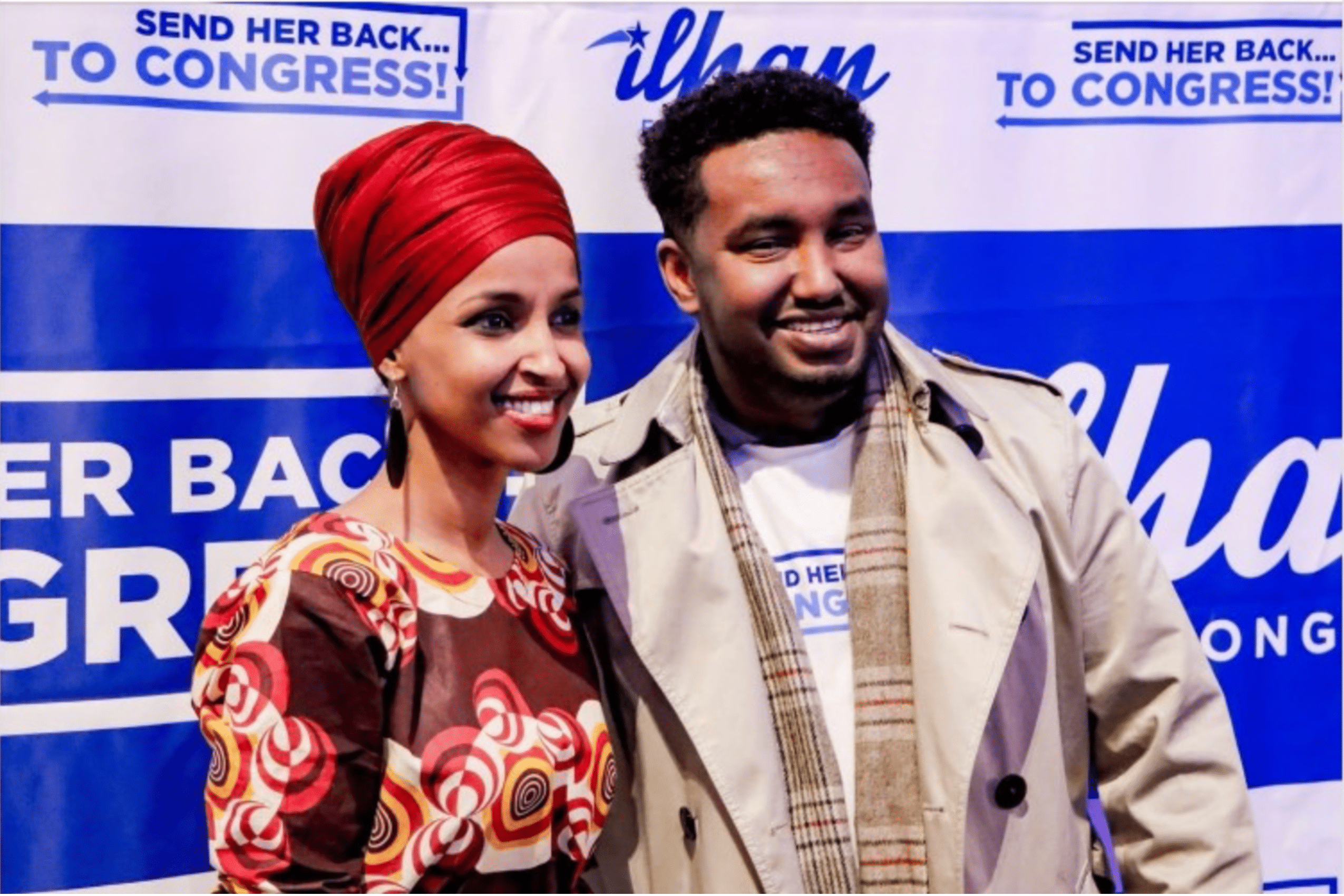

Safari Restaurant became a prosecution focal point when the owners were convicted of fraud. Co-owner Salim Said testified that the establishment played a kingmaker role in local politics: “If you don’t go through Safari, you don’t become a politician.”

Defense attorneys sought to introduce video of Omar appearing at events there. The restaurant allegedly received more than $16 million in fraudulent federal funds.

Calls for Transparency

Paul Kamenar, counsel for the National Legal and Policy Center, demanded greater transparency. “She was basically broke when she came into office, and now she’s worth perhaps up to $30 million,” Kamenar told The New York Post. “She needs to come clean on these assets.”

The NLPC filed an ethics complaint in June 2024 alleging Omar failed to accurately report Mynett’s financial assets and transactions.

The Winery Investment

Mynett’s major asset, eStCru winery, carries its own controversy. In 2021, investor Naeem Mohd wired $300,000 to Mynett and partner Will Hailer after being promised a 200 percent return within 18 months. When the deadline passed, Mohd received only his original investment back.

A California lawsuit accused them of fraudulent misrepresentation. Despite this, Omar’s 2024 disclosure valued eStCru between $1 million and $5 million.

Cannabis Debt

Partner Hailer settled a separate $1.2 million debt with South Dakota cannabis companies in August 2024. Hailer and Mynett’s company, eSt Ventures, allegedly promised to triple entrepreneurs’ $3.54 million capital within days or weeks.

When investments failed to materialize, lawsuits followed. Mynett claimed he withdrew from eSt Ventures in early 2022, before the cannabis deal, but he was named as a co-founder in legal filings.

Fraud Spreads to Housing

Minnesota’s crisis extends beyond child nutrition into housing assistance, autism therapy, and disability services. Prosecutors charged five new defendants in December 2025 for allegedly defrauding the Housing Stability Services Program. Another defendant allegedly submitted $6 million in fraudulent Medicaid claims through an autism services program.

Prosecutors say providers recruited children from Minneapolis’s Somali community and paid parents cash kickbacks for cooperation.

Integrated Community Support

Authorities served search warrants on Integrated Community Supports, which helps disabled adults live independently. Annual payments to providers skyrocketed to $180 million in 2025, a significant increase from the 2021 launch.

Governor Tim Walz ordered a third-party audit due by late January as confidence eroded. The Republican National Committee suggested Omar’s wealth surge raises transparency questions.

Taxpayer Dollars Equal Luxury Assets

Court documents reveal how conspirators spent money intended for vulnerable children. Ahmed Ghedi deposited more than $2 million into a shell company and spent over $245,000 on vehicles, $200,000 on credit cards, and approximately $560,000 toward a mansion in south Minneapolis.

Salim Said bought a pickup truck, his wife a Mercedes, and a $1.1 million Plymouth home with an indoor basketball court.

Terrorism Connection

The Treasury Department announced it would investigate whether stolen tax dollars reached al-Shabaab, the al Qaeda affiliate in Somalia.

Treasury Secretary Bessent testified that money from individuals charged in fraud cases “has gone overseas, and we are tracking that both to the Middle East and to Somalia.”

Omar’s Wealth

In a 2025 interview with Business Insider, Omar dismissed millionaire allegations: “Since getting elected, there has been a coordinated right-wing disinformation campaign claiming all sorts of wild things, including the ridiculous claim I am worth millions of dollars.”

Months later, her May disclosure revealed assets ranging from $6 million to $30 million. Most wealth stems from Mynett’s companies.

Rose Lake’s Unverified Claims

Rose Lake’s website presents the firm as a global powerhouse with “centuries of experience” across more than 80 countries through networks built in “business, politics, banking, and diplomacy.” It claims management of $60 billion in assets.

Congressional disclosure rules only require asset values in broad ranges, leaving significant transparency gaps. The firm’s claims haven’t been independently verified by the media or regulators.

Somali Community Caught in Crossfire

Approximately 89 percent of those charged in Feeding Our Future are Somali Americans. The concentration sparked debate about whether investigations unfairly target immigrants or reflect genuine criminal activity.

Governor Walz criticized President Trump for broadly targeting “an entire community.” Prosecutors stress that schemes were systemic fraud exploiting programs for vulnerable populations.

Ongoing Investigations

FBI Director Kash Patel surged personnel to Minnesota to dismantle fraud schemes. “Stealing $250 million from hungry kids to buy mansions and luxury cars is as shameless as it gets,” Patel wrote. Prosecutors continue to pursue additional charges while auditors determine the recovery possibilities.

The Government Accountability Office estimates federal taxpayers lose $233 billion to $521 billion annually to fraud.

Unresolved Questions

House Republicans launched an oversight investigation into Governor Walz’s fraud handling. No parallel congressional investigation into Omar’s finances has been announced, although the National Legal and Policy Center continues to press for transparency.

The full scope of Minnesota’s fraud crisis remains under investigation, with prosecutors acknowledging that new schemes continue to surface. Questions persist about how massive theft spanning 14 programs over seven years went undetected.

Sources:

U.S. Attorney Announces Federal Charges Against 47 Defendants in $250 Million Feeding Our Future Fraud Scheme” – U.S. Department of Justice

“Oversight of Feeding Our Future – Special Review” – Office of the Legislative Auditor, State of Minnesota

“Minnesota Department of Education: Oversight of Feeding Our Future – Special Review” – Minnesota Department of Education / Office of the Legislative Auditor

“Fraud Risk Management: 2018–2022 Data Show Federal Government Loses an Estimated $233 Billion to $521 Billion Annually to Fraud” (GAO-24-105833) – U.S. Government Accountability Office