Kentucky’s bourbon heartland is experiencing its gravest threat in nearly a century as bankruptcy filings ripple through rural communities whose entire economic foundations rest on whiskey production. Towns like Bardstown, Lawrenceburg, and Lancaster, which once thrived on distillery paychecks, now confront the stark reality that their primary economic engine is sputtering toward collapse, according to industry analysts tracking the crisis.

Wave of Bankruptcies Threatens Rural Kentucky Communities

Reports from Newsweek indicate that three major Kentucky distilleries have collapsed into bankruptcy within eight months, representing over $300 million in failed investments. The financial hemorrhaging threatens thousands of jobs in communities where bourbon provides up to 80% of economic activity, marking the industry’s worst crisis since Prohibition decimated rural Kentucky’s distilling towns in the 1920s.

From Agricultural Towns to Global Tourism Destinations

Kentucky’s bourbon renaissance began two decades ago, transforming sleepy agricultural communities into global tourism destinations, generating $400 million annually in visitor revenue. The Kentucky Distillers’ Association reports the industry expanded from 19 distilleries in 2008 to over 100 locations across 42 counties, creating what economists called a “river of money flowing down Bluegrass Parkway.”

Perfect Storm of Market Forces Devastates Industry

Multiple catastrophic forces converged by 2023, with the Distilled Spirits Council documenting American whiskey sales declining 1.8% in 2024 following a 0.4% drop in 2023. Nielsen data shows Generation Z’s abstinence from alcohol reached 45% while retaliatory trade tariffs slashed international exports. Kentucky now holds 14.3 million aging barrels, more than two per resident, while demand evaporates.

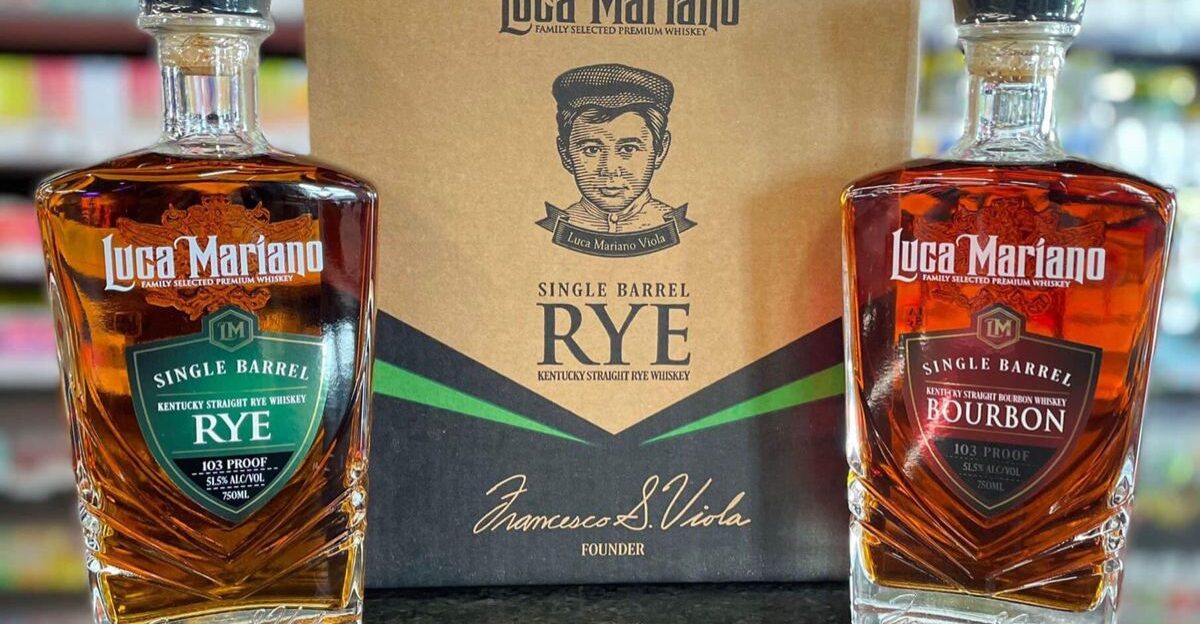

Luca Mariano Distillery Files Bankruptcy Just Weeks After Opening

LMD Holdings, owner of the Luca Mariano Distillery, filed Chapter 11 bankruptcy in July 2025 with debts exceeding $25 million, just five weeks after opening its $50 million Danville facility. The Lexington Herald-Leader reports the 553-acre estate’s immediate collapse sent shockwaves through an industry accustomed to decades-long aging cycles and patient capital investment strategies.

Lancaster’s $250 Million Distillery Dreams Shattered

Lancaster’s Garrard County Distilling entered receivership owing $26 million to Truist Bank after operating just 14 months, while its $250 million state-of-the-art facility sits idle. Bourbon Pursuit coverage reveals the closure eliminates hundreds of planned jobs in a rural community of 3,800 residents who had pinned economic revival hopes on the massive distillery investment.

Workers Bear the Human Cost of Industry Collapse

“We filed to maximize the value of the assets for all stakeholders,” Luca Mariano’s owner, Francesco Viola, told the Lexington Herald-Leader as his distillery’s bankruptcy crushed dreams of revitalizing rural Danville. Meanwhile, The Spirits Business reports Brown-Forman slashed 700 jobs while Green River Distilling eliminated 26 positions, representing 25% of its workforce.

Even Industry Giants Forced to Retreat from Expansion Plans

According to Newsweek, Diageo halted production at its Lebanon facility through June 2025, while Wild Turkey sales plummeted 8.1% as parent Campari Group reported significant U.S. market declines. Even Bardstown Bourbon Company, once the industry’s expansion darling with 110,000 annual barrel capacity, faces uncertainty as contract distilling demand evaporates.

Record Inventory Surplus Creates Cash Flow Crisis

Kentucky’s bourbon warehouses now store a record 12.6 million aging barrels worth billions in tied-up capital that won’t mature for years. Kentucky Distillers’ Association data shows the massive inventory surplus, accumulated during optimistic boom-year projections, has created a cash flow crisis as distilleries struggle to service debt while waiting for aged whiskey to become marketable.

Tourism Revenue Plummets as Distilleries Close Doors

Kentucky Bourbon Trail visitation, which peaked at 2.5 million experiences in 2024, generating $400 million in rural tourism revenue, faces steep declines as distillery closures eliminate destinations. Travel and Tour World analysis indicates small towns that invested heavily in bourbon-themed hotels, restaurants, and attractions now confront the loss of their primary tourism draw amid industry contraction.

Trade Wars Devastate Kentucky Bourbon Export Markets

Kentucky bourbon exports collapsed under retaliatory tariffs, with Canada ordering American spirits removed from government store shelves and the European Union threatening 50% levies by March 2025. The New York Post reports trade disputes have cost Kentucky bourbon exports half a billion dollars since 2018, devastating distilleries that expanded based on international growth projections.

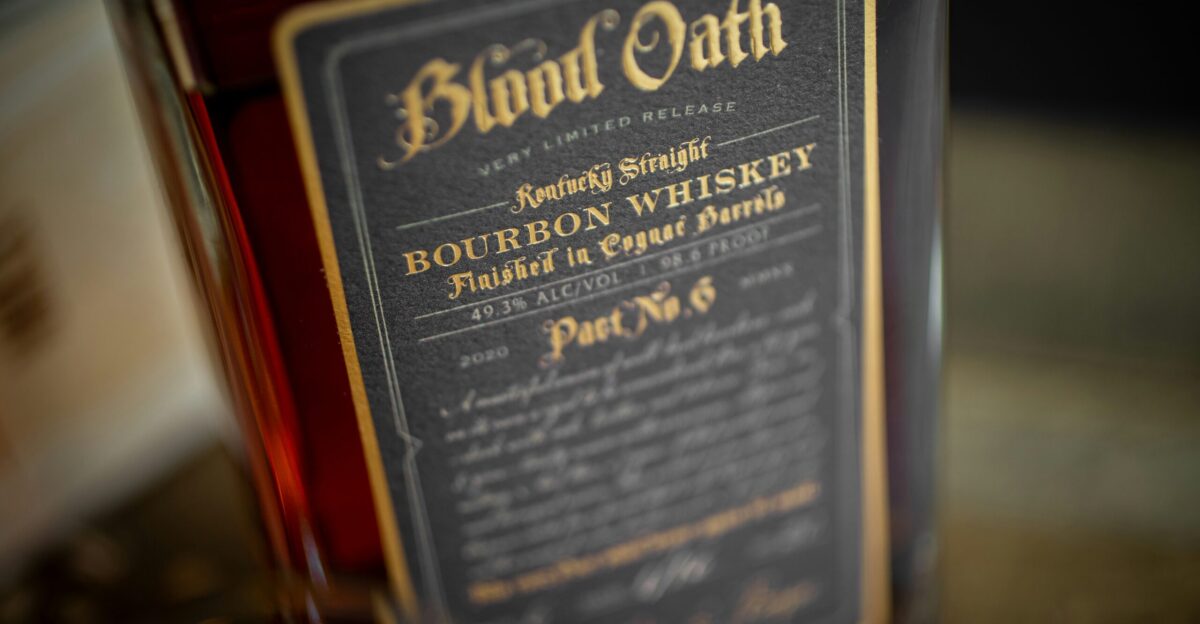

Kentucky Owl Owner Files Bankruptcy After Cyberattack

Stoli Group USA, Kentucky Owl’s parent company, filed for bankruptcy in November 2024 with $50-100 million in liabilities following a devastating cyberattack that crippled operations for months. The Spirits Business confirms the company’s planned $90 million Kentucky Owl Park in Bardstown, featuring a distillery, hotel, and entertainment complex, remains in limbo as creditors battle over assets.

Surviving Distilleries Scramble to Cut Costs and Find New Markets

Surviving distilleries frantically pivot toward ready-to-drink cocktails and premium segments while slashing production costs through facility closures and workforce reductions. Kentucky Tourism documents show Bardstown Bourbon Company completed a $28.7 million expansion, increasing capacity to 18 million proof gallons annually, but contract distilling demand has evaporated as clients cancel orders.

Industry Experts Warn More Bankruptcies Are Coming

“We’re in uncharted territory,” Distilled Spirits Council executives acknowledged as the crisis deepens beyond normal market corrections. According to Hip Hop Wired reporting, industry analysts warn that additional bankruptcies are inevitable as overleveraged distilleries struggle with debt service payments while facing years of declining demand and mounting inventory surpluses.

Kentucky’s Economic Future Hangs in the Balance

Kentucky’s bourbon industry confronts an existential crossroads where it must adapt to fundamentally changed consumer preferences and trade environments or face further consolidation that could shutter entire rural communities. The Kentucky Distillers’ Association notes the state’s 23,000 bourbon workers and $1.6 billion annual payroll hang in the balance as the industry’s future remains uncertain.

Political Leaders Unite to Defend Bourbon Industry

Senator Rand Paul argues that Kentucky bourbon “hates being a target in U.S. trade fights” as the industry’s economic importance in supporting rural communities across 42 counties makes it a critical political issue. Fox Business reports that Governor Andy Beshear and Senator Mitch McConnell have united across party lines to oppose tariffs that devastate Kentucky’s signature industry.

Global Shift Away from Traditional Spirits Threatens Industry

Kentucky’s crisis reflects broader international spirits market transformation as consumers worldwide shift toward lighter beverages and wellness-focused alternatives. The Distilled Spirits Council reports U.S. whiskey exports declined 5.4% to $1.3 billion despite record overall spirits exports, signaling fundamental changes in global drinking patterns that threaten traditional whiskey categories.

Bankruptcy Courts Struggle to Value Distillery Assets

Bankruptcy courts now grapple with valuing distillery assets, including aging whiskey inventory, sophisticated production equipment, and rural real estate, as creditors battle over billions in tied-up capital. Bourbon Pursuit analysis shows Truist Bank’s receivership of Garrard County Distilling establishes precedents for how lenders will handle future distillery defaults in an oversupplied market.

Younger Generations Reject Traditional Drinking Culture

The bourbon bankruptcy wave signals America’s evolving relationship with traditional spirits consumption as younger generations embrace “California Sober” lifestyles and wellness-focused drinking habits. Time Magazine research indicates social media trends promoting non-alcoholic alternatives have fundamentally disrupted century-old industry assumptions about American drinking culture and rural economic models.

Historic Crisis Rivals Industry’s Darkest Days Since Prohibition

Kentucky bourbon’s current crisis rivals the industry’s darkest period since Prohibition ended in 1933, when only four distilleries survived the 13-year alcohol ban that devastated rural communities. Bourbon historians note today’s convergence of changing consumer habits, trade warfare, and financial overextension may similarly determine which bourbon towns survive this unprecedented reckoning with America’s shifting cultural preferences.