America’s biggest retailers are facing a new kind of pressure, one that arrives just as consumers are already pulling back. A coordinated boycott campaign is colliding with economic anxiety, weak retail sales, and growing distrust of corporate power. Since early 2025, activist groups have targeted familiar household names, arguing the stakes go far beyond shopping habits. Here’s what’s really happening and why 2026 matters more than it seems. Let’s look into this deeper.

America’s Retail Giants Face Unusual Pressure

America’s 5 biggest retailers are under siege, not from supply chain chaos or lockdowns, but from a coordinated activist boycott demanding corporate accountability. This pressure coincided with collapsing consumer confidence and tightening household budgets, creating an unusually volatile moment for retail giants nationwide.

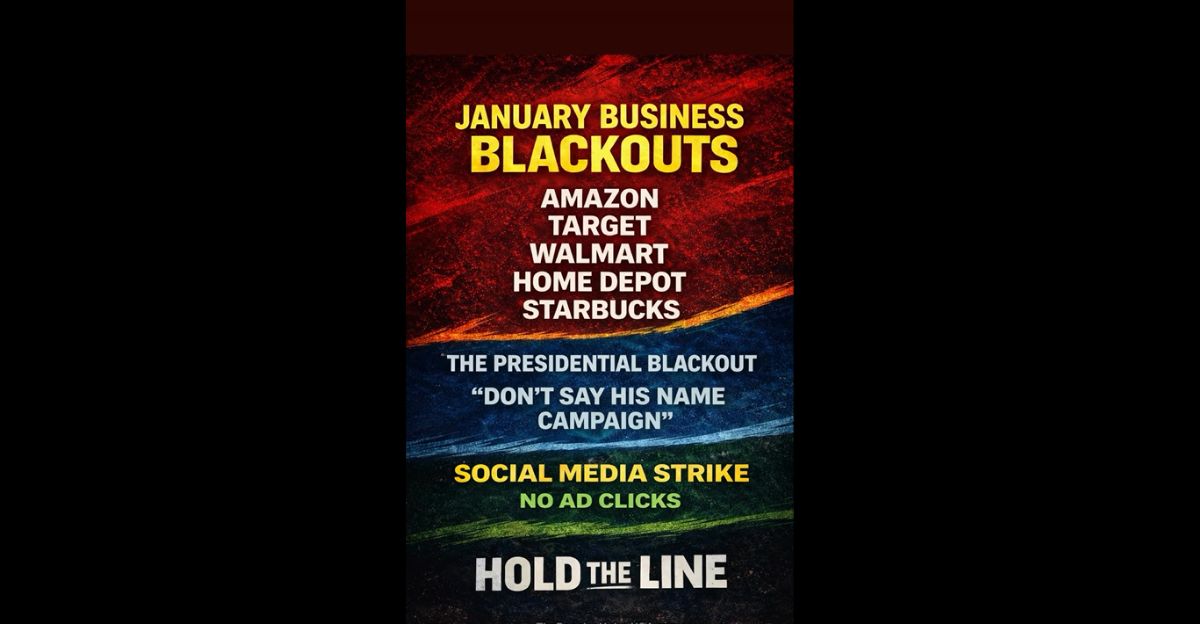

Who Is Driving The Boycott Movement

The People’s Union USA, founded by John Schwarz, launched a nationwide “Economic Blackout” on February 28, 2025. Unlike flash protests, this campaign was organized, strategic, and sustained. Activists demanded corporations “pay their fair share of taxes” and restore diversity programs. Groups like Black Voters Matter amplified pressure, extending what began as 1 day into a year-long confrontation.

A Retail Economy Already On Edge

January 2025 shocked economists when U.S. retail sales plunged 0.9%, far worse than the expected 0.1% decline. Analysts cited extreme cold, post-holiday fatigue, and California wildfires. Beneath that sat tariff uncertainty, lingering inflation fears, and the weakest consumer sentiment since November 2022. This fragile environment made boycott messaging resonate far more deeply.

Why These 5 Companies Were Chosen

Combined, these 5 Companies generate an estimated $7–$10 trillion in annual revenue and employ roughly 2.5–3 million Americans. Activists argue these corporations minimize tax obligations and rolled back DEI programs during 2024–2025, creating a powerful narrative around accountability and fairness.

Why The Stakes Reach Everyone

This campaign affects more than boardrooms. Roughly 2.5–3 million workers depend on these retailers, while 150–200 million U.S. households shop at at least 1 annually. Even a sustained 1% revenue hit could expose $63–$90 billion monthly. Store hours, staffing, and local economies hang in the balance, intensifying pressure across communities nationwide.

#1 Target

Target experienced the most visible fallout. Its stock fell 33% between January and April 2025, with market value dropping from about $129 billion to $41.6 billion by September. Foot traffic declined 8–11%, and Q2 comparable sales fell 1.9%. CEO Brian Cornell resigned in August 2025, cementing Target as the boycott’s defining symbol.

#2 Amazon

Amazon’s results contrasted sharply. During March 2025 boycott week, traffic rose 6%. Q1 2025 sales increased 10.3%, with shares trading near $184.42 by late April. Convenience, Prime loyalty, and diversification into cloud and advertising insulated Amazon from retail disruptions, highlighting how scale and habit can overpower coordinated activist pressure.

#3 Walmart

Walmart faced criticism but reported minimal sales disruption throughout 2025. The company emphasized $1.7 billion in annual cash and in-kind donations, framing itself as a community anchor. While activists challenged its tax practices, Walmart’s low-price positioning and rural reach kept traffic steady, suggesting affordability often outweighs values-based shopping decisions.

#4 Home Depot

Home Depot received less attention despite being included in boycott calls. Its contractor-heavy customer base reduced visibility, and some data suggested traffic increased as shoppers avoided competitors. Stock performance stayed stable during 2025, though detailed boycott-period sales figures were limited. Professional buyers appeared less motivated by corporate tax or DEI debates.

#5 Starbucks

Starbucks encountered pressure from overlapping boycotts, labor disputes, and price criticism. Its progressive brand identity made DEI rollbacks feel like betrayal to core customers. While systemwide sales data remains unclear, repeated blackout events hurt perception. Unlike mass retailers, Starbucks’ premium positioning makes it especially sensitive to values-driven consumer shifts.

Measuring Impact Is Surprisingly Difficult

Separating boycott effects from economic stress proved nearly impossible. With retail sales already down 0.9% nationally, analysts struggled to isolate causes. Target’s decline aligned with backlash, while Amazon’s growth defied narratives. Some economists argue perception damage matters more than sales, creating reputational risk regardless of measurable financial losses.

What Participation Data Reveals

Surveys showed 70% of boycott participants targeted Target, 66% avoided Walmart, and 64% avoided Amazon. Yet actual participation peaked around 9–12% of consumers. This gap between intention and action explains why Target suffered while Amazon absorbed losses. Habit-based retailers proved harder to disrupt than discretionary shopping destinations.

Tariffs Added Another Layer Of Stress

Potential tariff increases in early 2025 threatened higher prices across retail. Consumers already worried about inflation pulled back spending, blurring boycott effects further. Avoidance of Target or Walmart may have reflected cost anxiety as much as activism. These overlapping pressures created a rare moment where economic fear reinforced boycott momentum.

DEI Rollbacks Fueled Momentum

Between 2024 and 2025, Amazon, Target, and Walmart reduced DEI programs, citing efficiency. Activists framed the moves as abandonment of values, turning boycotts mainstream. Media coverage amplified the narrative, transforming niche protests into national debates. These policy decisions may have mattered more than any single organizing tactic.

Social Media Magnified The Pressure

Activist groups used coordinated hashtags, influencers, and platform algorithms to project scale. TikTok, Instagram, and Facebook pushed blackout dates to millions. Even limited participation looked massive online, pressuring executives and boards. A 12% participation rate can feel overwhelming when amplified to billions of impressions across social feeds.

When Boycotts Work And Fail

Effectiveness depended on switching costs. Target suffered because alternatives were plentiful. Starbucks faced pressure because coffee options abound. Amazon resisted due to convenience dominance. Walmart’s price leadership shielded it. Boycotts succeed when alternatives exist and habits break easily, but fail against entrenched convenience and necessity.

What 2026 Could Decide

Entering 2026, activists remain committed, while retailers adapt through messaging, philanthropy, and selective program changes. The next phase depends on the economy. Recovery could weaken boycott energy, while recession could strengthen it. Whether sustained pressure forces real policy change remains the unanswered question shaping the year ahead.

Consumer Power Versus Corporate Scale

This campaign tests modern consumer influence. Target shows coordinated action can hurt, but Amazon proves scale resists pressure. Starbucks highlights reputational vulnerability, while Walmart reflects price reality. The lesson is uneven power. Successful activism targets specific weaknesses, not entire industries, reshaping how future campaigns may unfold.

What This Means When You Shop

This year-long boycott changed how Americans view everyday purchases. Executives resigned, stocks fell, and reputations shifted. Outcomes were messy and uneven, but awareness increased. As 2026 unfolds, every swipe carries context, whether you act on it or not. The real question is understanding the stakes behind routine choices.

Sources:

“U.S. Retail Sales Drop 0.9% in January, Weather & Tariffs Weigh On Spending.” FX Empire, February 2025.

“People’s Union USA: Group Behind Feb. 28 Economic Blackout Consumers.” TIME Magazine, February 27, 2025.

“Consumers Boycott Target, Amazon, Home Depot—Here’s Why.” Yahoo Finance, November 23, 2025.

“Target Withstood DEI Boycotts To Show Signs Of Reputation Recovery.” Forbes, December 15, 2025.

“From Boycotts To Buybacks: Why Walmart Outshines Target In 2025.” Interactive Brokers, October 27, 2025.

“US Retail Sales Decline 0.9% In January vs. -0.1% Expected.” FX Street, February 14, 2025.