The U.S. debt clock keeps spinning past $37.8 trillion — a number so large it almost stops feeling real. Yet J.P. Morgan strategist David Kelly says this isn’t a sudden collapse but a slow drift. “America isn’t failing overnight,” he explained. “It’s going broke slowly.”

The words capture a dangerous kind of quiet: a steady erosion hidden beneath calm markets and political noise.

The Slow Slide No One Feels — Yet

Kelly compared the situation to a kicker in a roaring stadium: the crowd’s distracted, the game goes on, but every small mistake adds up. Markets behave the same way.

Investors stay focused on daily headlines, while the country’s balance sheet quietly weakens. “The danger isn’t crisis,” he said, “it’s complacency.” That subtle drift is what worries him — not panic, but the lack of it.

The Numbers Behind the Warning

J.P. Morgan estimates that the federal deficit will reach about $2.1 trillion in 2025, roughly 6.7 percent of GDP. Kelly warned that once deficits rise above 4.5 percent, debt climbs faster than growth can offset.

At that pace, America’s debt-to-GDP ratio could pass 102 percent within a year — placing the U.S. among the most indebted economies on the planet.

Borrowing to Pay What’s Already Owed

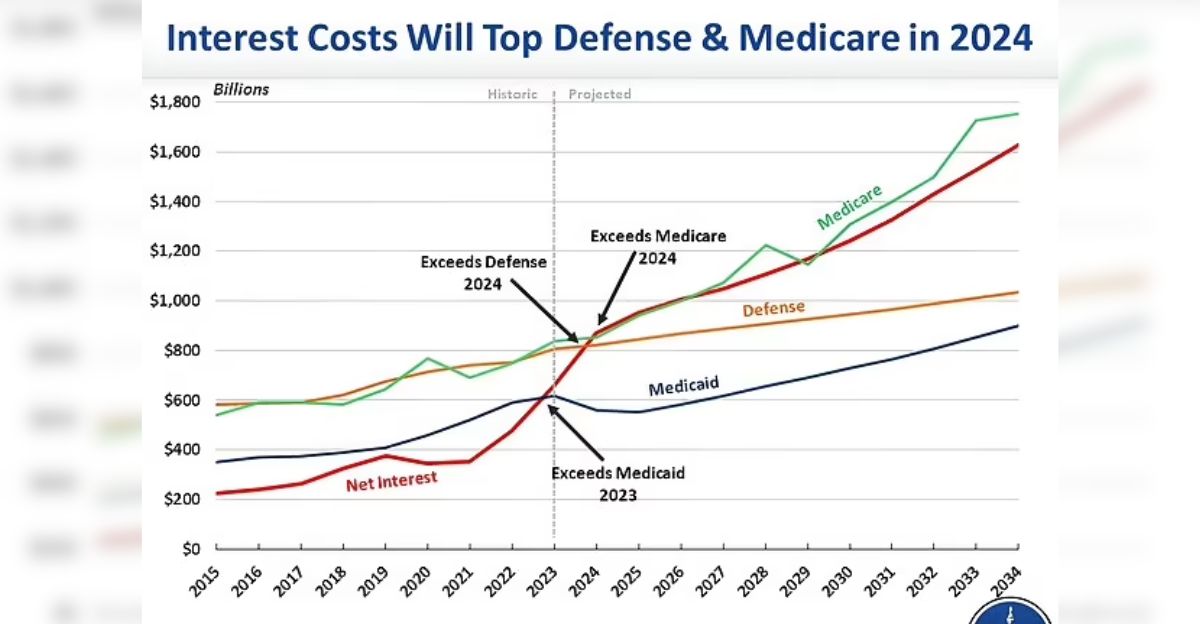

Interest on federal debt is projected to exceed $1 trillion this year, overtaking defense spending for the first time in history. That means the government borrows money to cover interest on previous borrowing — a fiscal treadmill that speeds up the longer it runs.

Kelly called it “a treadmill with no off-button,” one that drains national resources without building anything new.

How the Spiral Took Shape

The seeds were planted years ago through generous tax breaks, pandemic-era stimulus, and expanding entitlement obligations. Kelly pointed to “populist spending” and frequent policy shifts that widened deficits even in years of solid growth.

He said both parties have learned to promise prosperity on credit, a habit that now defines federal budgeting. As he put it, America’s finances are “balanced on borrowed time,” and these 10 warning signs are becoming impossible to ignore.

1. Interest Costs Outweigh Defense Spending

For the first time, interest payments exceed defense spending. Kelly said this inversion “marks a fundamental shift in priorities.” Every dollar devoted to interest is a dollar unavailable for education, infrastructure, or innovation.

The United States is now spending more to service yesterday’s promises than to prepare for tomorrow’s threats.

2. The $37 Trillion Ceiling Has Disappeared

The debt didn’t just cross $37 trillion — it shattered that threshold with little debate. Even if spending froze, compounding interest alone could add another trillion within a year. What unsettles Kelly most isn’t the spike itself but how normal it feels.

“The extraordinary,” he said, “has become ordinary.” The U.S. has stopped reacting to the very numbers that once shocked it.

3. Growth Can’t Keep Up

Economic growth hovers near 0.25 percent, far below the 2.5 percent needed to stabilize debt. “You can’t outrun borrowing if the economy barely moves,” Kelly warned.

Low productivity, aging demographics, and cautious business investment all slow momentum. Without faster growth, each new budget digs the hole deeper — even when the economy isn’t in crisis.

4. Deficits Have Become Permanent

Deficits were once a wartime or recession response. Now they’re a permanent feature of American life. J.P. Morgan projects annual shortfalls of 6 to 7 percent of GDP through the 2030s unless major reforms occur.

“The U.S. is running emergency-level deficits in normal times,” Kelly said, calling it a sign that fiscal policy has lost its anchor.

5. Tariffs Offer Short-Term Relief — and Long-Term Risk

Trump-era tariffs bring in $30 billion to $35 billion each month, cushioning revenue figures. However, Kelly warned that the benefits could be reversed overnight if courts strike them down.

Should refunds be required, that steady stream becomes new debt. “It’s a fiscal Band-Aid,” he said, “not a cure.” Tariffs may mask the problem, but they can’t solve it.

6. Tax Breaks That Backfire

Temporary tax cuts enacted in 2024 delivered a short-term boost to consumer spending — and a long-term hit to revenue.

As the credits fade, new political pressure builds for more giveaways. Kelly described it as “a sugar high that costs trillions.” The pattern repeats every few years: relief today, red ink tomorrow.

7. Entitlements Running on Autopilot

Social Security and Medicare expand automatically with demographics, regardless of the economy’s strength. Even in growth years, their costs rise faster than GDP. Kelly said these programs “guarantee baseline deficits keep rising,” unless lawmakers address long-term solvency.

Cutting benefits is politically toxic, but ignoring them, he warned, is financially reckless.

8. Little Incentive to Change Course

Investors still buy U.S. Treasurys despite record borrowing at roughly 4.6 percent yields. That steady demand creates a false sense of safety. “It’s complacency disguised as confidence,” Kelly said.

As long as markets remain calm, there’s no political reward for tough choices. The quiet trust of investors may be what delays — and eventually magnifies — the reckoning.

9. Global Instability, Local Fragility

Trade wars, regional recessions, and energy shocks are chipping away at growth. Each global flare-up raises costs for consumers and businesses at home.

Kelly warned that “fiscal fragility meets global volatility” is a dangerous mix: the U.S. faces mounting obligations precisely as the world becomes harder to predict.

10. From Slow Decline to Sudden Shock

Kelly’s sharpest warning is that slow decay can turn fast. “We could move from going broke slowly to going broke quickly,” he said. A surge in interest rates, a weakening dollar, or foreign investors pulling back could accelerate the fall.

Confidence, once lost, is hard to rebuild — and America’s fiscal margin for error is shrinking.

Calm Markets Can Be Deceptive

For now, U.S. assets still look safe. Treasurys remain the world’s preferred refuge in uncertainty. But Kelly warned that calm can hide danger.

“When no one’s worried,” he said, “that’s when the damage grows quietly.” The absence of fear allows imbalances to deepen until correction becomes unavoidable.

Why Investors Should Pay Attention

J.P. Morgan CEO Jamie Dimon recently cautioned that credit quality across public and private sectors is deteriorating. Rising borrowing costs could lead to tighter lending and higher default rates.

“What happens in Washington doesn’t stay in Washington,” Kelly said. Fiscal strain eventually filters through the banking system to ordinary households.

What Could Push the System Over the Edge

A recession would strike at the worst possible time. Falling tax revenue and emergency spending could add trillions more to the deficit almost overnight.

“One downturn,” Kelly said, “can erase five years of progress.” In a high-debt environment, every crisis hits harder, leaving fewer tools to fight the next one.

How to Slow the Slide

Kelly believes restraint is still possible — just unlikely. “Fiscal discipline isn’t popular until the pain arrives,” he said. Cutting discretionary spending, reforming entitlements, and stabilizing tax policy could slow the drift, but they require political courage.

For investors, he recommends diversification: international equities, real assets, and inflation-linked bonds as safeguards against a long squeeze on U.S. debt.

The Real Meaning of “Going Broke Slowly”

Kelly’s warning isn’t about collapse; it’s about choices. “America isn’t failing,” he said. “It’s losing flexibility.” The country still commands the world’s trust — for now.

However, each year of inaction makes that trust more expensive to keep. In his view, going broke slowly is simply what happens when the alarms keep sounding and no one turns down the noise.